The post Against protectionism and widespread populism, we need to reinvent a globalization more inclusive appeared first on La Nouvelle Tribune.

]]>Chief Executive, City and Financial Global Ltd, organizer of the City Week of London

City & Financial Global Ltd is one of the UK’s leading research-based conference companies specialising in high-level international conferences in the fields of Finance, Fintech, Cyber-finance and risk management to name a few.

It is the organizer of City Week, its flagship event which takes place in London every year, in partnership with the City of London Corporation, TheCityUK, the Department of International Trade, etc. City Week is the leading forum for the international financial services community bringing together over 700 delegates from more than 50 countries around the world each year.

The CEO and founder of City & Financial Global Ltd, M. Maurice Button, was kind enough to respond to La Nouvelle Tribune and www.lnt.ma’s questions, on the sidelines of the 2019 edition of City Week, which was held in London’s Guildhall on May 20th and 21st.

La Nouvelle Tribune:

The theme of the 2019 edition of City Week is « FINANCIAL SERVICES AS A DRIVER OF INCLUSIVE GLOBALIZATION ». Why did you choose such a theme?

M. Maurice Button:

The world has entered a phase of deglobalization, protectionism and widespread populism, largely in response to the financial crisis and its impact on the real economy.

This is evidenced by the election of President Trump, BREXIT and the surge in populist, nationalist poiliticians in Europe and elsewhere in the world, such as Brazil.

These political movements have drawn on the support of large parts of society that have begun to feel disenfranchised, ignored and marginalized by, as they perceive it, the political elite. They also feel that the economic benefits of globalization have passed them by and that there is a growing gulf between the rich and the poor.

The only way of countering this rising tide is to reinvent globalization and to make it more inclusive. Hence the theme of this year’s City Week.

How do you reconcile this approach, which puts London at the center of global financial services, with Brexit-related developments? Is the London market still as attractive, and will it still be in the coming months?

London is a global financial centre, not simply a European one. Its time-zone, its well-respected commercial legal system, the advantage of English being the business language of choice globally, the unparalleled nexis of financial skills and expertise to be found in London, the depth of its capital markets, its preeminent position in foreign exchange trading, the size of its asset management and hedge fund industries, the fact that it is home to Lloyd’s of London and is a top centre for international insurance, and the inventiveness and adaptability of the City of London and its financiers, as demonstrated over many centuries – all stand it in good stead for the future.

Furthermore, the centre of gravity of finance and economic growth is shifting inexorably towards the East, particularly China ands South East Asia. The majority of growth in GDP in the decades to come is expected to come from this region. London is well positioned to benefit from this shift and to help finance the growth in the region.

Globalization is essential to financial operations and has contributed greatly to their development. Will it still prevail as we witness it being strongly challenged, particularly in the United States, champions of unilateralism with Mr. Trump, or in several countries in continental Europe?

As mentioned above, we are currently experiencing a push back against globalisation, free trade and the institutions that have supported the world economic order since 1945. Populist politicians have stoked up discontent and promised simplistic solutions to those in society that have felt left behind, marginalized, alienated or simply cheated by income inequality in their countries.

However, there are valid reasons for this discontent and, if globalization, with its enormous capacity to generate wealth and be a force for good in society, is going to regain the ascendancy and win the argument against populist politicians, then it does need to change.

Its proponents need to listen to their critics and to respond. It needs to become much more inclusive and transparent.

The wealth it generates needs to be shared more fairly. In particular, trust needs to be restored in the honesty and integrity of financial institutions. Fair and transparent regulation shoud ensure that the primary purpose of financial institutions is to meet the financing needs of the real economy and consumers.

Numerous topics that will be debated during this edition relate to Europe and the integration and development of financial services. Do you believe that London’s place will remain the heart of financial operations to and from the Old Continent?

Continental Europe does not have well-developed capital markets, which is why European governments and companies have historically come to London to raise capital.

The European Commission is well aware of this and launched the European Capital Markets Union project a few years ago. ECMU was, in fact, the brainchild of Lord Hill, the UK’s then EU Commissioner for Financial Services.

The question is whether ECMU will have much traction and also how long it will take to take shape. The difficulty is that the reason why continental Europe does not have well-developed capital markets is as much to do with cultural preferences as it is deficiencies in market structure or the legal system.

As a result, continental Europe is much more dependent on bank lending, which in turn is constrained by the balance sheets of its banks. For those European governments and companies that want to raise large sums, London’s capital markets are likely to be their first choice for the forseeable future.

What lines of thought could be outlined about the global financial regulation?

There are many topics in global financial regulation that came up during the discussions at this year’s City Week, but one of the most important was operational resilience.

Operational resilience is at the top of most national financial regulators’ agendas, but, surprisingly, there isn’t an international regulatory framework for it in the same way that we have the Basel Accords for banking supervision, IOSCO for the securities and futures markets, the IAIS for insurance, the CPMI for payments and the IASB for accounting standards.

And yet the need is certainly as great, as it is operational resilience that will be the key determinant for how deep the next financial crisis will be, and how fast and how far it will spread.

It is also crucial at a more day to day, micro level in terms of the durability of individual firms and their ability to compete and survive.

Furthermore, it is one of the key safeguards that protects the interests of consumers, investors, employees and the wider stakeholder community.

How should we define operational resilience?

In short, it is the ability of firms, financial market infrastructure companies and the sector itself to prevent, respond to, recover from and learn from operational disruptions of all kinds.

The forms of operational disruption have become more complex and intense in recent years, as the pace of technological change has become more rapid and the cyber environment has become more hostile.

Is green finance now a booming financial field? What are the paths of its upcoming development?

Green finance is set to be one of the dominant themes in finance over coming decades.

Without doubt, the Paris Agreement and the UN Sustainable Development goals have raised international awareness of the financial impact of climate change.

They have also increased collaboration efforts to transition to a low carbon economy, including the growth of green finance.

However, the sector remains comparatively tiny. Moody’s expects global sales of green bonds to be US$200 billion in 2019, after just 6% growth in 2018.

According to a recent discussion paper published by the FCA late last year, 38 green companies had raised US$10 billion in London at that point, including 14 renewable investment funds.

In the retail banking sector, green mortgages have been launched, as well as a number of asset/investment management products.

This is pretty small beer, and certainly won’t go far in terms of saving the planet. But this could be about to change. Regulators across the world have been driving a number of initiatives that could substantially increase the growth in green finance.

At the supranational level, the Financial Stability Board’s (FSB) Taskforce on Climate Related Financial Disclosures (TCFD) has launched an initiative aimed at helping companies quantify the risks associated with climate change, such as the physical effects of climate change on their operations and the impact of new green policies on their business models and their customers.

The TCFD is backed by companies responsible for some $100tn of assets. While it is currently a voluntary initiative, international regulators, such as the Bank of England and the FCA in the UK, are exploring whether it should be a mandatory requirement for financial services firms to report publicly on how they manage climate risks to their customers and operations.

And the FCA is also planning to consult on how all quoted companies, i.e. the large corporate customers of financial institutions, should report to the markets about their climate change risks.

This, in turn, would enable institutional shareholders to factor climate risk into their investment decisions with greater certainty. These enhanced reporting and disclosure requirements on financial institutions and their corporate customers may just be the incentives that are required to scale up green finance.

In order for the green finance market to flourish a further requirement is to agree on common, minimum standards and guiding principles for measuring the performance and impact of green finance products.

Minimum standards and a common taxonomy would enhance investor confidence and trust, thereby stimulating the market.

The EU Commission’s ‘Sustainable Finance Action Plan’, launched last year, seeks to do just this by introducing (a) a taxonomy for what should be considered as an ‘environmentally sustainable economic activity’, (b) new low carbon benchmarks to give investors guidance on their carbon footprints and (c) new disclosure obligations for institutional investors and asset managers.

Taking all the above regulatory initiatives into account, 2019 should see the start of real growth in green finance.

Interview conducted by Ms. Afifa Dassouli, London

The post Against protectionism and widespread populism, we need to reinvent a globalization more inclusive appeared first on La Nouvelle Tribune.

]]>The post Help! The nation’s steel-maker under threat from the pro-dumping lobbies! appeared first on La Nouvelle Tribune.

]]>Reflecting on its future, the various threats undermining it, the serious shortcomings plaguing it and its very future itself in light of a series of recent events, is therefore a priority which needs to be rapidly resolved if it is to be given the best possible chance of success.

Indeed, faced with the hollowing out of our country’s industrial landscape over the last decade which has result in the loss of tens of thousands of jobs, we urgently need to consider a number of key factors if we are to provide a pragmatic response to the challenge of unemployment, especially among youngsters.

Donald Trump, a champion of protectionism

First, there is an evident need to strongly promote and orient investment towards industrial projects that provide jobs and ensure a degree of self-sustainability in meeting the country’s needs with a view to reducing the country’s trade deficit.

But there is also a need to preserve at all costs what already exists, that is to say, the existing industrial units that are struggling hard to survive and thrive in an international environment that has become deeply hostile.

This is characterised, in particular, by highly-developed dumping practices as well as the policy of safeguarding national interests by major industrial powerhouses which, to a certain extent, have revived interest in a form of protectionism, despite the WTO’s directives and recommendations.

A number of industries are now impacted, even threatened, by these latest developments, particularly the steel industry, which is the subject of a fierce war waged by major producers as well as by a number of States and their leaders.

One of the most telling examples is unquestionably that of the United States as typified by President Trump’s actions aimed at blocking entry into his country of steel produced in China, Russia, Turkey, Ukraine, Latin America or anywhere else.

These producers, which have been denied access to the US market, are shifting their attention to other regions and countries and are increasingly resorting to dumping measures, targeting those that are perceived as being the weakest.

These countries, like their ‘large’ counterparts, therefore need to preserve their existing units and ensure that local production is, to a certain extent, protected as provide for by the WTO policy’s general safeguard and anti-dumping provisions.

It is well known that the steel market is a global industry but the growth dynamics in terms of global demand and the pace at which new capacity is being installed make it highly cyclical. Since the beginning of the decade, however, the sector has experienced significant overcapacity and many analysts do not envisage a return to equilibrium before 2025.

Given that the steel industry is considered strategic for industrialised countries, the latter began to adopt, as early as 2012, an arsenal of trade defence measures, making it by far the most protected sector in the world.

And low-cost producers, engaging in dumping practices, have seen the major markets in America and Europe shut their doors to their exports. In addition, major industrialised countries have exerted strong pressure on China, obliging it, since 2015, to embark on a closure programme for many steel mills.

And while steel, together with aluminium, was the first product to incur additional duties imposed by the Trump administration, the European Union has acted similarly by imposing provisional safeguard measures on a wide range of steel products. And in both cases, the additional 25% duty came on top of the previous protectionist measures.

Such is the international backdrop against which Morocco’s public policy needs to be analysed, a policy which aims to protect domestic steel production in all its forms.

Morocco’s open-door policy

Given what is happening internationally, it is abundantly clear that Morocco currently has one of the most ‘liberal’ (lax?) policies when it comes to protecting its domestic production as well as being one of the least protected countries within the region among those with steel production capacity.

In fact, for hot-rolled steel for example, only European and Turkish steel incurs an anti-dumping duty of 11%. Imports from other countries which have a free trade agreement with Morocco are exempt all duties. As a result, US exports to Morocco are exempt while Moroccan exports to the US incur duties of 25%. Imports from other countries incur a 10% charge under the Common Customs Tariff system.

As a result, a suitably low-cost Ukrainian exporter will see its cargo taxed at the rate of 10% in Morocco versus 25% in the US, 77% in Canada, 25% + 15% in Mexico, EUR 60 + 25% in Europe and 20% in Iran.

Its Russian ‘counterpart’, equally low-cost, will see its cargo taxed at the following rates, depending on the destination:

Morocco: 10%

US: 25% + 74-185%

Mexico: 21% + 15%

Europe: EUR 96 + 25%

Thailand: 128%

Iran: 20%

South Africa: 20%

India: 10% + minimum price incurred

For a Chinese exporter of cold-rolled steel, the following rates apply:

Morocco: 16%

US: 25% + 266% + 256%

Canada: 92% + 12%

Mexico: 15% + 66% + 103%

Europe: 25% + 20%

It must be understood, however, that, given these rates and international market prices, there is no gain to be had from Morocco protecting an obsolete steel sector with production units below international industry standards.

Indeed, the steel industry is a heavy industry requiring a high level of mastery when it comes to production processes. As a result, to achieve the best possible results, the industry needs to invest in people, leverage its know-how and adopt rigorous production systems.

Today, Morocco can take pride in having industrial flagships that have progressed rapidly along the learning curve while improving performance in line with international standards. For example, at one of Maghreb Steel’s sites, processing costs fell by 20-40% at constant prices between 2014 and 2018 for its various lines.

Furthermore, at Sonasid’s and Maghreb Steel’s steel mills, consumption ratios for the main consumables are lower than the international average.

We’re not suggesting protecting an underperforming industry or adopting a rent-seeking approach but, rather, preserving the Kingdom’s national interests, its industrial fabric and the jobs that it generates.

Mention could be made, for example, of Maghreb Steel, whose past difficulties are well-documented. For more than three years, the steel-maker has been implementing a business recovery plan which has involved restructuring its production facilities with the government’s support. It has also enjoyed a moratorium on its high levels of debt from a number of local banks.

As part of this rescue operation, Maghreb Steel has recruited more than 400 executives and engineers. Their jobs and those of other Group employees would be under threat if the public authorities, which have until now turned a deaf ear to pressure from local lobbies, were to endorse the pro-dumping measures of importers partnering low-cost producers from Central Europe or Russia.

It must also be clearly recognised that, despite its industrial performance, the domestic steel industry remains fragile and is penalised by the country’s limited domestic market.

In this industry, economies of scale are needed to ensure a return on assets. Similar safeguard measures to those adopted by other industrialised countries within the region regarding processed products would allow producers to focus their efforts on their main challenge, which is to expand their market and promote steel usage.

Like the other countries that preceded Morocco in adopting a successful development model focusing on national interests, developing the country’s industrial fabric and its steel industry is something which must be done in parallel, with a long-term vision, government support and the disqualification of unfair competition. Because no country has industrialised without having a strong iron and steel industry!

Neither more nor less than the others!

Morocco’s development model must incorporate its industrial sector if it is to escape the ‘middle-income trap’. And, as mentioned above, the stakes are enormous in terms of jobs, value added and the trade balance, not to mention the social impact and the contribution to economic development from having a strong middle class, with a knock-on effect on other productive sectors.

That is why protectionist mechanisms, as permitted by the WTO, must be maintained to give sufficient time to emerging industries to improve their cost structures and their productivity to be able to build a genuine industrial base, as has been done by every developed country in the past.

Contrary to the allegations and posturing by a handful of importers of steel products which have only their own narrow interests in mind and which demand an end to the safeguard measures for steel, the government must continue to provide provisional and temporary protection. This must be the sole criterion which should be legitimately considered when it comes to the domestic steel sector’s sustainability, as the basis for a global and national industrial development model.

The effective protection that Sonasid has enjoyed in its speciality segment, that of long steel, should continue to be implemented for Maghreb Steel’s flat steel segment, so that the nation’s steel production is sheltered from international predators which know only too well how to activate their local networks at the risk of jeopardising the nation’s successful industrial concerns.

Afifa Dassouli

Original article : https://lnt.ma/secours-siderurgie-nationale-menacee-lobbies-dumping/

The post Help! The nation’s steel-maker under threat from the pro-dumping lobbies! appeared first on La Nouvelle Tribune.

]]>The post Education, “Do you speak Arabic”? appeared first on La Nouvelle Tribune.

]]>The purpose of this somewhat curt preamble is to make the reader understand that, for our ‘politicians’, there is no sense of urgency since our country’s educational system would appear to be in an excellent state … as can be seen from the high school dropout rates, the tens of thousands of unemployed who wield diplomas that are entirely denigrated and rejected by potential employers, the massive number of students enrolled in ‘worthless’ faculties such as Law, Social Sciences and the Arts etc. as well as the profound and structural divide in educational provision between the private and public sectors.

Our honourable parliamentarians and the parties – at least some of them – which pull their strings have no obvious remedy to these undisputed realities, which have lasted for years.

Because politicking and demagogical, populist, vote-catching and, lastly, ideological posturing would appear to be far more important than passing legislation that will stand for a number of years about an issue that is so vitally important to Morocco and its future generations!

An alliance of conservatisms

“But where is the problem?” is a question which might be asked by parents who are legitimately concerned for their offspring.

We are told that the problem lies with the choice of the language of instruction, particularly for scientific subjects and with the definition of vocational teaching modules, that is to say, with the linguistic media other than our two official languages, Arabic and Tamazight.

Two major political parties, the PJD, which heads up the parliamentary majority and Istiqlal, which forms part of the opposition, uncompromisingly champion the cause of the Arabic language.

Mr Saad Eddine El Othmani and his friends above all challenge the choice of French for scientific subjects, the language of Molière being for such folk a tool used to adulterate our national identity and for embracing Westernisation and every conceivable (moral) evil that the latter begets.

The PJD, which in any case is unable to radically oppose legislation that has been approved by the Council of Ministers, is engaged in a war of attrition and is fighting a rear-guard action by proposing to substitute the language of Shakespeare for that of Victor Hugo.

A highly improbable endeavour that makes us think of Queen Marie Antoinette who, when faced with the cries and anger of the protesting crowds demanding bread, proposed that they be given cake …

Istiqlal, despite being currently led by Mr Nizar Baraka, a young, open-minded and educated man who speaks a number of languages, is even more radical and uncompromising, challenging foreign language usage, even for scientific disciplines. Instead, the party advocates the ‘Arabisation of knowledge’ and the exclusive use of Arabic rather than French and English for subjects which, the world over, are mainly taught in one or either of these two languages.

Quite evidently, by adopting such a stance, there is more than just a hint of electoral posturing with a strong tinge of populism which, more recently, encompasses a number of political statements (electronic invoicing, common company identifier (ICE), etc.).

But, is it not simply a case of “making a mountain out of a molehill”, as the adage goes.

Because, the root of the problem does not really lie in the choice of language used in vocational training or even the very principle underlying this choice but in our being able to and needing to provide our children with effective and modern cognitive tools, consistent with the demands of globalisation, embracing the wider world and upgrading our educational model in line with international standards.

It is patently clear, however, that the current system has failed, and every Moroccan knows that only too well.

If it were not so, private education, from pre-school to university, would not have grown so rapidly in recent decades.

If it were not so, employers in search of effective human resources that are capable of meeting meet the needs of businesses would not be complaining day and night about the lack of suitable candidates.

If it were not so, the statistics would not reveal such a shortage of Maths and French teachers while young teachers, hurriedly recruited to offset the retirement en masse of senior teachers, would not be putty in the hands of skilled manipulators dispatched by Al Adl Wal Ihssane sympathisers.

If it were not so, the current cultural and linguistic attainment levels of our students would not be what they are today, as poorly developed as their ability to write, express themselves and tear themselves away from the oft-evil clutches of social media!

If it were not so, as can be verified by anyone, the French-speaking sections of this country’s Law faculties would not be overwhelmingly filled by modern languages graduates with very little knowledge of French, but who consider that a language degree offers a better chance of getting a job!

If it were not so, everyone in this country would be eager to recall a remark made by the late King Hassan II, who rightly considered anyone who could speak only one language as illiterate!

Morocco does not figure prominently when it comes to global performance indicators, far from it! One of the major reasons is our education system and the graduates that the latter generates.

And if some remain entrenched in their retrograde, backward-looking and counter-productive positions, it is almost certainly because they are the system’s presumed offspring …

Unfortunately for us all!

Fahd YATA

Original article : https://lnt.ma/enseignement-do-you-speak-arabic/

The post Education, “Do you speak Arabic”? appeared first on La Nouvelle Tribune.

]]>The post Bank Al-Maghrib, the limitations of an accommodative monetary policy appeared first on La Nouvelle Tribune.

]]>Indeed, in the aftermath of the 2007-2008 financial crisis, Mr Jouahri, its Governor, understood that the traditional role of the institution that he heads up could no longer be limited to containing inflation to avoid a decline in purchasing power.

He therefore introduced a new set of bank refinancing instruments for domestic banks, which, as a result of the crisis, might encounter liquidity shortfalls.

The reason being, was to enable them to continue, in turn, to finance the economy.

At the same time, the Central Bank embarked on a policy of lowering its key interest rate to enable the banking system to offer competitive lending rates for wealth creation.

After four rate cuts, the key rate, known as the ‘base rate,’ has stood at 2.25% since 2017.

Ne varietur!

Expectations by businesses and financial institutions were for BAM’s Board to maintain an accommodative policy to support economic growth.

They again expressed this wish in September and December 2018, after the Central Bank had left its key interest rate unchanged at 2.25%, which it considered an appropriate level given the country’s macroeconomic fundamentals.

In fact, there is widespread belief that, given the current slow rate of GDP growth, BAM could do more to incentivise bank lending with further cuts to its key interest rate.

Adopting an even more accommodative monetary policy would push down lending rates still further and boost the financing of the economy through larger loans.

Indeed, it is clear that non-agricultural economic growth is stabilising at a level that is below its long-term potential. This would appear to be corroborated by the Central Bank’s medium-term forecasts, which are hardly optimistic, and which have not seen any noteworthy changes recently. Inflation is forecast at 1.2% for 2019 and at 1.4% over an eight-quarter timeframe, while bank lending, which has stagnated for several months, is showing signs of weakness.

However, with the benefit of hindsight, the transmission of monetary policy into bank lending is easily discernible, despite the fact that low rates do not automatically impact growth in loans to the economy!

For example, in 2012, banking lending grew by about 10% while the key interest rate was only 3.25%. However, after four consecutive rate cuts, each of 25 basis points, loan growth has not picked-up but, on the contrary, has in fact continued to decline!

Bank lending saw a first deceleration phase towards the end of 2015, slowing to below 1% and has since only slightly recovered with growth currently running at between 1.5% and 3%.

On the other hand, it is clear that the transmission system of monetary policy into bank lending rates has functioned correctly. It can be seen from the trend in bank rates that, since 2012, each time the Central Bank has cut its key interest rate, the effect on lending rates has been almost identical.

In fact, when the base rate was cut by 100 basis points, the overall lending rate went from an average of 6.42% to 5.35%, a drop of 107 points, i.e. an entirely consistent move.

Conversely, is would be reasonable to ask why bank lending does not automatically grow when key interest rates and bank lending rates fall?

The answer is certainly economic since a pick-up in bank lending depends on other factors, the main one being business confidence in the private sector. The fact that, since 2012, public spending has contributed significantly to economic recovery by boosting aggregate demand is evidence of this.

Treasury investment has steadily increased and currently accounts for just over 6% of GDP.

As a result, since 2012, outstanding loans to non-financial public enterprises have spontaneously doubled.

Confidence, confidence, confidence …

By comparison, over the same period, outstanding loans to non-financial private enterprises have declined by MAD 20 billion to MAD 346 billion.

At 31 December 2018, outstanding bank loans stood at MAD 866 billion, a 2.7% year-on-year increase, albeit slightly below the 3.1% rate of growth posted a year earlier.

Every loan category listed in the Central Bank’s statistics (equipment, treasury, real estate and consumer loans) registered weak growth.

More seriously even, in 2018, average outstanding bank loans stood at only MAD 841 billion, an increase of just 2% year-on-year i.e. the weakest rate of growth over the past 20 years.

One thing is clear, which is that growth in bank lending has remained weak for more than six years.

Year-on-year annual growth in bank loans has fluctuated between a peak of 4.6% in 2012 and a trough of 2.2% in 2014.

Since March 2012, the Central Bank has cut its key interest by 25 basis points on four occasions. As we have shown above, the cuts have been fully passed on to borrowing costs without there being any meaningful impact on bank lending!

As a result, the effectiveness of monetary policy cannot be called into question! The question might also to be ask what would have actually happened to bank lending if BAM’s monetary policy had not been so accommodative. Perhaps loan growth might have been even weaker!

And if we look back to 2007, it can be seen that growth in bank lending enjoyed a somewhat euphoric phase which saw the year-on-year annual growth rate exceed 30% when the economy was growing by 6%.

Growth in bank lending was even thought to be excessive as illustrated by the increase in non-performing loans from 4.3% in 2011 to 7.9% in 2016.

As it stands today, the economy has undergone a certain degree of deleveraging as illustrated by the ratio of bank loans to GDP, which has fallen by 10 percentage points from 85% to 75%.

Lastly, if it is confirmed that the current level of bank lending is consistent with non-agricultural growth of between 3% and 3.5%, then loan growth is likely to hit a ceiling at around this level over the next two years.

In the meantime, monetary policy in a low interest rate setting, with no meaningful expansion in bank lending on the horizon, has led to a significant decline in bond yields and has trimmed the investment returns of institutional portfolios, life insurance funds and investment savings, raising a fresh risk of economic deterioration which can only be detrimental to our country’s overall growth!

Afifa Dassouli

Original article : https://lnt.ma/bank-al-maghrib-limites-dune-politique-monetaire-accommodante/

The post Bank Al-Maghrib, the limitations of an accommodative monetary policy appeared first on La Nouvelle Tribune.

]]>The post Eeny, meeny, miny, moe, in which direction will Algeria go? appeared first on La Nouvelle Tribune.

]]>But can we genuinely celebrate the anniversary of a regional entity which, apart from a handful of bureaucratic structures filled by career diplomats, only exists in a formal capacity on the paper on which the Constitutive Act of the ‘Treaty of Marrakech’ was drawn up?

While this thirtieth anniversary passed by completely unnoticed by the peoples of the Maghreb, their respective partisan political institutions and the media, the Algerian President, Abdelaziz Bouteflika, alone deemed it worthy to make public and official mention of it, marking the occasion with a message to the King of Morocco, His Majesty Mohammed VI.

The reader will be spared the sickly-sweet convolutions that pepper this text. We will instead focus exclusively on the proposal of Algeria’s Head of State to mark the occasion with a ‘break’, for the purpose of collectively reflecting on how to revive a shared vision for the Maghreb and, consequently, its regional construction.

The Algerian authorities’ deep-seated malaise

A willingness to revive a North African vision is scarcely plausible, however, without definitively settling some essential prerequisites over which the Algerian authorities, with as much diligence as hypocrisy, have taken great care to stall for several decades.

The Arab Maghreb Union is an abortive institution precisely because the Algerian State has never consented, in almost half a century, to stop interfering and end its policy of systematically blocking Morocco’s goal of achieving national and territorial unity.

Algiers, which continues to host, finance, arm and support the mercenary Polisario separatists, is the iniquitous and sole mastermind of a hypocritical policy which consists of doing the exact opposite of its promises, declarations of faith, assurances and formal undertakings!

And it is the President himself, Abdelaziz Bouteflika, who has assumed the principal role, which is to issue pious platitudes on the one hand while pursuing, on the other, his viscerally anti-Moroccan designs!

This double-talk, in reality, reveals the Algerian authorities’ schizophrenic state. There is nothing to indicate that this sad state of affairs, often accompanied by paranoia, will end in the near future.

How could it be otherwise with the Algerian people preparing to go to the polls for presidential elections in which Abdelaziz Bouteflika, 81, affected by a massive stroke since 2013, will run for a fifth term?

Such behaviour is utterly surrealist and inacceptable to any rational and logical mind, so too, the fact that the entourage of a diminished President, who is unable to get about, has difficulty speaking and is isolated in a presidential complex that is as closed as was the Chinese Empire’s Forbidden City, is to impose this state of affairs on millions of our neighbour’s citizens?

Of course, the future of the Algerian people does not concern us directly because it alone is master of its own destiny and any interference in that country’s internal affairs is not permitted.

But is it really a question of ‘interference’ in showing our concern about what is happening in Algeria in the knowledge that, in reality, power has been confiscated by a camarilla dominated by President Bouteflika’s family and supported by the military high command?

Given the fact that we are neighbours as well as fellow members of the Maghreb, we surely have the right to question the consequences of a new presidential term by a man who is barely capable of mastering his thoughts which, in any case, he can no longer express?

In Algeria and across the Algerian diaspora, voices are already expressing their refusal of this latest hoax which is only permitted because the various clans jostling for power still consider that Bouteflika’s candidacy is the only one which, by default, suits them all?

Morocco, standing firm!

Do we, Moroccans, onlookers to this debacle over which Algerian citizens themselves have absolutely no control, still believe that there is any hope left in the Algerian President, a president who, on the one hand, proposes a menopausal or andropausal AMU (each to his own), while, at the same time, engages his Tindouf mercenaries to challenge our sacred national unity in a variety of ways?

In fact, regarding this relationship in which official Algerian discourse acts as a conduit for its intellectual dyslexia, the Kingdom has taken great care to implement policies that are designed to protect its interests and consolidate its territorial integrity.

And, despite the fact that, since the start of the 1970s, obstacles have been systematically put in our way, Algeria has never been able to prevent, at the local level, our national flag from being flown uninterruptedly in our Southern Provinces!

And, given the diplomatic successes across the continent, the growing achievements within the African Union, massive European parliamentary approval for the Morocco-EU agricultural and fisheries accords, allocation by the US Federal Budget of loans for our Southern Provinces that are to be managed and underwritten by Rabat, everything would suggest that the Kingdom is beginning to reap the rewards of its policy of persevering in defending its inalienable rights.

It is impossible to predict where the current Algerian authorities’ decline will lead, as it disappears into the darkness of irrationality and pig-headedness.

But Morocco will not change course and will wait, patiently and determinedly, for the wind to change direction as far as our neighbours are concerned.

So, when President Bouteflika proposes that we take a break, we would suggest that he has a rest…

Fahd YATA

Original article : https://lnt.ma/123-va-lalgerie/

The post Eeny, meeny, miny, moe, in which direction will Algeria go? appeared first on La Nouvelle Tribune.

]]>The post The Fondation Jardin Majorelle have agreed to the sale of Villa Mabrouka in Tangier appeared first on La Nouvelle Tribune.

]]>As per instructions of the late Pierre Berge, co-founder with Yves Saint Laurent of the Fondation Jardin Majorelle, the entire proceeds of sale of the property will benefit the Moroccan not-for-profit Fondation Jardin Majorelle, which oversees the Jardin Majorelle, its Berber Museum and the musee YVES SAINT LAURENT Marrakech. The foundation’s earnings are used to finance cultural, educational or charitable initiatives in Morocco.

Originally purchased and restored by Yves Saint Laurent and Pierre Berge in the late 1990’s, the Villa Mabrouka was home to late couturier in the final decades of his life. Both Mr Saint Laurent and Mr Berge had longstanding and profound ties with the Kingdom of Morocco.

A resident of Marrakech, the acclaimed British designer Mr Conran will undoubtedly continue the rich heritage of the property and contribute to the vibrant and cosmopolitan revival of Tangier currently underway.

LNT with press release

The post The Fondation Jardin Majorelle have agreed to the sale of Villa Mabrouka in Tangier appeared first on La Nouvelle Tribune.

]]>The post “Donald Trump doesn’t have a Middle East policy. It’s non-politics!” Interview with journalist and producer Sofia Amara appeared first on La Nouvelle Tribune.

]]>She was the first female journalist to enter Mosul with the Iraqi army when it was liberated as well as covering the Arab Spring in Egypt. Despite the risks, she has produced a number of reports and films about Syria and the war raging there since 2011.

We owe a huge debt to Sofia Amara’s brand of meticulous investigative journalism in exposing and denouncing the crimes of Daesh, those of Bashar al-Assad’s regime and of Islamist militias and in raising public awareness and understanding around the entire world about these issues.

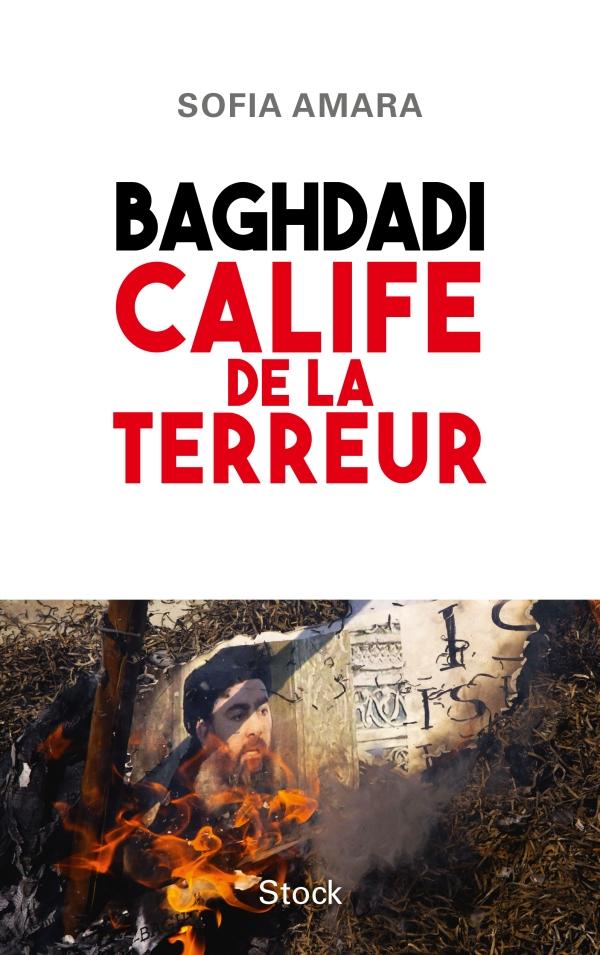

She has just written an authoritative book on Daesh’s founder, entitled ‘Baghdadi, the Caliph of Terror, published last October by Stock, a French publisher, which explains Daesh’s origins and the personal story of its chief executioner, Aboubakr Baghdadi.

On visiting Casablanca last December to present this must-read book, she was kind enough to answer, in an all-encompassing and forthright interview, questions put to her by La Nouvelle Tribune.

Fahd YATA

La Nouvelle Tribune:

As it stands, a section of the international press and public opinion considers that the war in Syria is over and that Bashar al-Assad, with his Russian and Iranian allies, is the big winner. It would seem that only a few pockets of Daesh resistance remain in northern Syria. What is your opinion? Do you think that we have now returned to a pre-2011 Syria?

Sofia Amara:

Bashar al-Assad cannot be the big winner because he is not the main player in this conflict! The fact that he has been able to win back a large part of Syrian territory is down to the help and military support from his two allies, Iran and, in particular, Russia. But this has come at a price, a loss of both independence and freedom of choice. But he not been able to engineer a return to the situation as it was before, far from it.

Syria is playing host to not only the Russians and the Iranians but also the Turks and the Americans, without forgetting of course the Kurds, ‘boosted’ by their military victories. Every type of militia and thirty-four factions of the Free Syrian Army still have a presence there.

We also shouldn’t forget about the human cost of this conflict which will likely see Bashar brought before the International Court of Justice at some point in the future.

We will never return to a pre-2011 Syria after this monstrous chapter in Syria’s history, which Bashar imposed on his country and his people. Syria has been completely destroyed, millions of citizens are now exiled, foreign forces, both friendly and enemy, are encamped on its soil and the civil war has above all caused considerable damage to Syrian society.

And how can he regard himself or claim to be the winner when a large section of the international community considers him to be a war criminal?

But can’t the virtual disappearance of Daesh as a State that was partially established on Syrian territory and which, more or less, was the main adversary, be considered a victory for Bashar al-Assad’s regime?

Absolutely not! Of course, that’s Assad’s theory and he desperately wants public opinion to believe it. But it’s wrong. The Damascus regime’s main opponent is the Syrian Democrats, whom he threw into jail, tortured or killed in their hundreds of thousands while, at the same time, freeing jihadists from his jails in order to discredit the peaceful revolt of 2011. Daesh was not the Syrian regime’s adversary but its instrument, its ally, for pragmatic reasons. The terrorist organisation was neutralised when it no longer served any purpose, rather than the other way around.

But where are these Syrian Democrats? Can they be regarded as a credible alternative to the current Syrian regime?

They are everywhere, in Scandinavian countries, in France, in Canada, in Lebanon … They are fighting for a democratic Syria and they will surely end up getting one someday.

For them, the enemy is both Bashar and Daesh. They had to fight two enemies at the same time. With the emergence of the second, Daesh, there was no room left for the alternative that they intended to establish. Bashar al-Assad’s bet was “either me or chaos”! And he generated this chaos, in the ruins of which all contradictory voices were buried.

Assad is not of course Daesh’s only ‘sponsor’. This organisation’s precursor was established on Iraqi soil in 2006 following the US invasion of Iraq and the collapse of Saddam Hussein’s regime three years earlier. But Bashar al-Assad’s strategy, to confront the challenge posed by his own people, was to stir up this jihadi monster.

On that basis, do you think that the United States is partially responsible for triggering the civil war in Syria itself?

No. It is worth remembering that this civil war only broke out after months of bloody repression by the Syrian regime of what had been a peaceful revolt. The Americans are neither responsible for this protest movement nor for the fact that it degenerated into a fratricidal conflict.

American responsibility lies elsewhere.

In 2001, the United States did not have a go at its Saudi ally despite the fact that the majority of the 9/11 terrorists were Saudi citizens. Instead, they preferred to attack bin Laden’s Afghanistan before invading Iraq in 2003 on the false pretext that Iraq possessed weapons of mass destruction.

The invasion placed an avenging Shia power as head of the country and saw the Iraqi army dismantled, consequently replaced by unlawful militias. During the occupation, the worst possible abuses were committed by American troops as well as by Iraq’s new masters. These included arbitrary arrests, humiliating acts, acts of torture, assassinations … as revealed in the various testimonies on the conditions of internment in Abu Ghraib prison.

America’s primary responsibility lies in the fact that it fostered an environment that was conducive for the Islamic State of Iraq, Daesh’s ancestor, to emerge.

It was Bashar al-Assad, in particular, who subsequently took up the cause, fuelling the war in Iraq. Not out of friendship for the Iraqis or Arab nationalism but out of pure calculation.

The Syrian regime thus recruited, trained and armed jihadists on its soil, before injecting them into the Iraqi quagmire.

At the time, Bashar al-Assad’s calculation was simple – he needed to complicate the task faced by the American occupier in Iraq, so as to dissuade it from attacking Syria.

Bloody jihadist attacks, which saw US soldiers killed as well as hundreds of civilians in Iraq, were planned in Syria under Syrian leadership.

This policy ended when Bashar al-Assad was obliged, under pressure from Washington and, in particular, the then Secretary of State, Colin Powell, to jail jihadists returning to Syria, after being driven out of Iraq by the latter’s Sunni Iraqi, supported by the US military.

These jihadists were detained in the infamous Saydnaya prison near Damascus, where they behaved as if they were actual leaders, enjoying their jailers’ favour, while the Syrian Democrats were humiliated, beaten, tortured and put to death in the same prison, qualified by Amnesty International as a ‘human slaughterhouse’.

The terrorists were then released from Saydnaya by Bashar al-Assad in 2011 so as to jihadize the Syrian revolt.

The Americans’ second responsibility lay in Obama’s climb-down in the wake of the chemical weapons attack on the suburbs of Damascus in 2013.

The United States had been a ‘passive spectator’ in this war, doing little more than reiterating the fact that the use of these prohibited weapons was a red line that the Assad regime must not cross.

Despite the summer 2013 attack, however, Obama decided not to punish Damascus.

A blank cheque for Assad. And one of the reasons why more moderate rebels fled into the extremists’ arms.

How was Daesh financed?

Daesh was able to generate the USD 2 million that it needed for its daily operations by engaging in profitable trafficking activities – the trafficking of oil, antiquities and human beings. Girls from the Yezidi minority were sold for 10,000 euros or more, if they were virgins.

There was also cotton production in the Syrian provinces of Deir Ez-Zor and Raqqa.

In addition, taxes were imposed by Daesh on the people then living under its yoke. Everyone had to pay – ordinary citizens, small businesses, drivers transporting goods … Even Lafarge Group is suspected of having financed the Islamic State to be able to continue running one of its factories in Syria.

And we also shouldn’t forget the looting of banks in Daesh-controlled regions.

What has been the role of the Gulf states in the civil war in Syria?

They helped ‘Islamise’ the Syrian revolution.

Military aid from the West to moderate rebels, mainly the Free Syrian Army, was insufficient.

Sometimes, this Western aid even ended up, via Qatar, in the hands of extremist factions.

In addition, countries such as Kuwait, Saudi Arabia and Qatar (individuals, NGOs and governments) provided support to FSA brigades and, taking advantage of the lack of aid from the West, Islamised them.

That said, the most dangerous of these organisations, Daesh, did not simply rely on Gulf donations in order to function. These donations were marginal by comparison with the colossal sums that the Islamic State was able to garner.

Why did the Arab Spring of 2011 occur simultaneously in Tunisia, Egypt, Libya, Syria, Bahrain, Morocco …

A number of uprisings failed while others succeeded. A particular theory often expounded, no doubt dear to the ‘conspiracy theorists’, is that the Arab Spring was in fact the realisation of Obama’s speech in 2009, which set out the American vision of democracy for the Arab world. This vision was also seen to be reaching out to Islamists such as the Muslim Brotherhood.

The protest movements of the Arab Spring can be seen as a rejection of ‘hogra’ (meaning, a sense of contempt shown by the State with regard to its people). Inspired by the success of the Tunisian revolt, Arab peoples living under dictatorships or authoritarian regimes felt insulted that they were deemed incapable of rising up, albeit belatedly, to demand democracy.

There was clearly a domino effect. Furthermore, to suggest that it was remote-controlled from abroad totally belied the actual facts on the ground.

I covered this revolt and was jailed in Cairo on two occasions alongside the activists who initiated the protest.

It was the April 6 Youth Movement which called on protesters to demonstrate in Cairo’s Tahrir Square on 25 January 2011, Egypt’s National Police Day. It was meant to be a simple demonstration, a dry-run prior to a more widespread demonstration which it intended to organise for the elections scheduled for late 2011.

But success was achieved so quickly thanks to social media and Mubarak was deposed in just 17 days. And when Hillary Clinton went to Cairo after the fall of the Egyptian president, the April 6 Movement refused to see her, blaming the Americans for supporting Mubarak to the end.

Egypt’s Muslim Brotherhood had watched this mobilisation with suspicion, even hostility. But it was achieved without them.

But wasn’t it the Islamists who, in the first instance, benefited from the Arab Spring?

In Egypt and Syria, it was the Muslim Brotherhood, in Tunisia, Ennahda, and even in Morocco with Al Adl Wal Ihssane and the PJD, etc.

You ask the question the wrong way around. It doesn’t matter who benefited. What matters is whether these parties were democratically elected. And then, of course, we need to ask ourselves why these people voted for Islamists; and how to steer this Islamised electorate into excluding religion from politics once and for all.

Admittedly, the peoples of the Arab region are all ‘Islamised’ but this does not explain the electoral victories, unless of course these movements were actively supported, encouraged and financed; because political power can never be attained without financial resources.

Islamist movements, particularly in Tunisia and Egypt, which suddenly came out of hiding, quickly won the popular vote …

But that’s not the problem. Parties have the right to finance their political action. What the public needs to know, however, is whether these financial arrangements were legal or not, internal or foreign. It is incumbent upon the judicial system, another pillar of the rule of law, to decide.

Except, the people voted for the Islamists because they had been Islamised. Some voters did not care much about the name of the party or candidate they voted for as long as he was an Islamist.

Lastly, the example of Egypt, the birthplace of the Muslim Brotherhood, that you mention, does not provide any evidence.

Secrecy has never been an obstacle to political or military victory, quite the contrary! It is in hiding that the Khomeini Cassette Tape Revolution took place. It is in secrecy that Baghdadi prepared the conquest of his self-proclaimed caliphate.

Sadly, the aftermath of the Arab Spring has provided little benefit to the peoples who started it.

Libya no longer exists, Syria is destroyed, Iraq is torn between Sunnis, Shiites and Kurds and Egypt is back in the hands of the army.

In what state is today’s Arab world?

Do you not think that Spring has turned into Winter? What are the lessons you have learnt, as an expert?

The Arab winter is an easy and deceptive allegory. Democratisation is a long process. We cannot judge history while we are still living in the present!

Of course, chaos currently reigns. People’s situations have taken a backward step. But need we consider that the Arab Spring has been of no use?

First, the most worrisome conclusion that I draw does not relate to the Arab world but to the powerful countries which have shown that the international community no longer exists.

Instead, there are crisis managers who act on the basis of their own interests which often change and are sometimes poorly calculated.

The Security Council is inoperative. Bloody-thirsty dictators still find backers in the West and chemical weapons are used without any reaction.

The so-called ‘free’ world has thrown in the towel.

In Iraq and Syria, Daesh managed to capture a territory as vast as Britain and it took more than three years to dislodge it …

The Arab world has certainly taken a backward step, underlining the high level of political immaturity in many cases.

Four dictators have been toppled, however.

Impunity is a thing of the past, in my opinion. It’s clearly not the optimal solution but it is already miraculous because there has been an enormous lead weight burdening Arab countries since the end of colonisation. Something had to give!

We’ve taken a backward step? It’s not surprising! But does it justify maintaining dictatorships? Ask those Syrians who lost their parents, their children, their homes if they regret their revolution. Many continue to say that “it was needed”!

And I would add that the more we delay the democratisation process in the Arab world, the more expensive it will be at the check-out till.

Are there currently any democratic forces within the Arab world that are capable of instilling and realising this sense of hope, when the majority of elites have fled their countries and unable to lead a revolution from abroad?

They will come back. General de Gaulle was abroad in London when the Nazis were in Paris. It doesn’t mean anything.

Syrian Democrats are in exile because they risk death if they return home. And then, we have to start somewhere.

Societies that have lived under dictatorship for decades, deprived of democratic norms, have done whatever they could.

In Syria, for example, despite 40 years under the Assads, the opposition has managed, through the Syrian National Council, to produce a credible alternative, made up of researchers, sociologists, women, Christians … They have done everything to prove that they were genuine democrats, worthy of taking over; but they have been side-lined by extremism due to inadequate Western action.

Finally, to conclude this very comprehensive interview, what do you think of Donald Trump’s Arab policy? The rules have gone out of the window, multilateralism has been blown to pieces with the American president preferring a bilateral approach.

And the key components of his Arab policy are poorly understood. We feel that, in reality, it is very erratic.

On the one hand, he supports democracy; on the other, he accommodates Assad and Russian support in Damascus. He has also done his best to exonerate the Saudi Crown Prince of the accusations brought against the latter after the murder of the journalist Jamal Khashoggi inside the Saudi consulate in Istanbul …

Donald Trump doesn’t have a Middle East policy. It’s non-politics!

Before he took office, three pillars underpinned this policy – oil, Israel’s security and the fight against Islamic terrorism.

These are America’s main concerns in respect of the Arab world.

This still holds true under Trump, but with two new features.

On the one hand, a heavy dose of political cynicism which at least has the benefit of frankness. Ignoring the heinous crime perpetrated against the Saudi journalist is one of the latest examples of it.

European countries are getting on with it or are trying to make the necessary adjustments wherever they can, despite the general cacophony. As far as Arab States are concerned, they are completely off the radar and should ask themselves why, instead of systematically accusing the West for all their ills.

On the other hand, Trump displays a worryingly high level of ignorance about the region and shows no inclination to be advised by competent experts.

The American President would appear to function on an ad hoc basis, as though driven purely by impulse.

When confronted by the intolerable images of the Syrian victims of Khan Shaykhun’s chemical attack, Trump was clearly overwhelmed and decided to hit back at Syria.

A serious act, which he implemented over small-talk during a dinner with his Chinese counterpart, Xi Jinping.

When interviewed by Fox News, he mentioned that he was “enjoying the most beautiful piece of chocolate cake” with his Chinese guest when he told him that he had just ordered the bombing of Syria. And during the interview, Trump even mistakenly confused the target country, confusing Iraq with Syria.

And the Syrian adventure stopped there.

Tomorrow, if someone convinced him that Assad was an infallible bulwark against Daesh, then he would likely visit him in Damascus!

For him, the last one to speak is right.

Interview by Fahd YATA

* Sofia Amara is an international reporter and producer of award-winning documentaries such as ‘The Lost children of the Caliphate’, which was awarded the AMADE Prize at the Monte-Carlo TV Festival, as well as the author of ‘Infiltrator into Syria’s hell on earth’ (Stock).

NB: This interview was conducted a few days before President Donald Trump’s decision to withdraw US troops from Syria.

‘Baghdadi, the Caliph of Terror’, by Sofia Amara

‘Baghdadi, the Caliph of Terror’, published by Stock, October 2018

Abu Bakr al-Baghdadi is something of an enigma. Is the most wanted man in the world still alive?

Where is he? Who is he really? What does the Caliph of Terror want to bequeath? What will be his legacy, the infamous Daesh brand?

He managed to create a Jihadistan, attracting fighters from all over the planet. He exported his model of terror to the heart of the free world. He is the perpetrator of a number of bloody terrorist attacks across our cities.

But the ghost with the black turban, who has a $25 million ‘Wanted’ tag on his head, is nowhere to be found.

(Editor’s note)

Recommended reading or viewing:

http://www.editions-stock.fr/livres/essais-documents/baghdadi-calife-de-la-terreur-9782234084919

Show reel: https://vimeo.com/58384452

Latest:

‘The Lost Children of the Caliphate’, Envoyé spécial/France 2 https://www.dailymotion.com/video/x6lw28x

‘Baghdadi, the Caliph of Terror’

Link: https://vimeo.com/212600399

Original article : https://lnt.ma/ny-a-de-politique-arabe-de-donald-trump-cest-de-non-politique-entretien-journaliste-realisatrice-sofia-amara/

The post “Donald Trump doesn’t have a Middle East policy. It’s non-politics!” Interview with journalist and producer Sofia Amara appeared first on La Nouvelle Tribune.

]]>The post Details of the final chapter of SALAFIN’s acquisition of TASLIF appeared first on La Nouvelle Tribune.

]]>Indeed, Extraordinary General Meetings were held by Salafin and Taslif on the final day of 2018 to approve an equity issue reserved for Taslif’s shareholders and complete the merger between the two companies with Salafin acquiring Taslif and, in the process, deciding to keep its corporate name.

It is worth recalling that the merger of the two consumer credit companies, announced in January 2018, could have been completed much more quickly and certainly in less than the one-year period which had elapsed between announcing the deal and its completion.

And with good reason. A deal had been struck between Taslif, a Saham Assurance subsidiary, with Moulay Hafid El Alami and Said El Alj as shareholders, and Chairman Othman Benjelloun’s group.

This consisted of selling Taslif to Salafin, with the latter legally acquiring the former, without requiring any other authorisation or the need to consult the market.

And all the more so given the fact that the merger terms had been fixed and the deal price set at 24 DH per share on the open market.

Which meant that Taslif’s retail shareholders still had until 28 December to either sell their Taslif shares on the open market or wait to convert them into Salafin shares.

However, the sale of Saham Finances and therefore of its Saham Assurance subsidiary, Taslif’s majority shareholder to SEM, a South African company, resulted in a change in Taslif’s reference shareholder with Sanlam becoming, directly or indirectly, the majority shareholder.

As a result, Bank Al-Maghrib had to give its consent and approval to SEM becoming Taslif’s majority shareholder.

SEM was required to make a public offer to buy out minority shareholders.

This was followed by an application for Sanlam to be authorised as a finance company and an AMMC visa application for a Taslif takeover bid, not to mention Salafin’s visa application for an equity issue which was, however, inescapable.

Thus, a takeover bid for Taslif’s shares and rights was launched by SEM Ireland, Saham Finances, Saham SA, Saham Finances Participations, Saham Assurance, Sanam Holding and Mr. Said Alj, each being a direct or indirect shareholder in Taslif.

This takeover bid, whose details were outlined in a formal prospectus approved by the AMMC 4 October 4, was held 11-17 December.

It is worth specifying that that the offer was for 1,556,911 Taslif shares i.e. 7.25% of the company’s share capital at a price of MAD 24 per share.

The Stock Exchange published the results of this consultation Monday 24 December.

1,049,813 Taslif shares were tendered, representing 4.89% of the share capital.

38 shareholders thus sold their shares prior to the merger with Salafin, i.e. 67.43% of the offer.

A small holding of less than 4% owned by CDG accounted for a large portion of these shares.

The cost of this takeover bid to Sanlam Emerging Markets, for which it was responsible as TASLIF’s majority shareholder, amounted to more than MAD 25 million …

In addition, 17 December, the Moroccan Capital Markets Authority (AMMC) approved the prospectus in relation to Salafin’s equity issue in respect of the Taslif acquisition.

This issue was exclusively reserved for Taslif’s existing shareholders, modified somewhat by the results of the takeover bid, with the reference shareholder bolstered by some 5%.

The equity issue consisted of 550,577 shares, issued on the basis of precise terms of exchange.

In fact, the chosen exchange ratio was one SALAFIN share for 39 TASLIF shares.

In other words, based on the price of one TASLIF share being 24 DH, the price of one SALAFIN share was 936 DH.

The total size of the equity issue in question, including the issue premium, of course, and on the basis of a 100 DH nominal value, amounted to MAD 515,340 million.

This equity issue, aimed at attracting new shareholders within Salafin’s ownership structure, was put before Salafin and Taslif’s shareholders for their approval at EGMs held Monday 31 December 2018.

It was these two transactions that delayed the merger of these two finance companies, to the point that the EGMs had to be held on the deadline date of 31 December 2018, which could not be delayed any linger given the size of the merger in question and due to the aggravating legal circumstance of it being backdated to 1 January 2018, in accordance with the agreement signed between Taslif’s sellers and acquirers.

Taslif is therefore going to be delisted in favour of a new Salafin, bolstered not only with the assets and staff of the acquired company but with its customers and partners.

But Sanlam Emerging Markets, Taslif’s previous owner, has not finished with rearranging its operations in Morocco.

In fact, it expects to launch another takeover bid, on Saham Assurance, whose prospectus is due to be approved by the AMMC very shortly and which outlines the terms governing its acquisition of Saham Finances.

Afifa Dassouli

Original article : https://lnt.ma/details-de-lacte-final-de-labsorption-de-taslif-salafin/

The post Details of the final chapter of SALAFIN’s acquisition of TASLIF appeared first on La Nouvelle Tribune.

]]>The post Hurry, the hounds… appeared first on La Nouvelle Tribune.

]]>Not a single day has gone by since that fateful Monday 17th December without Algerian hacks shamelessly rejoicing in this barbaric act, taking advantage of this tragedy to stigmatise Morocco and Moroccans, portraying them, from first to last, as supporters or active members of Islamist terrorism.

The scavengers …

Quoting an article from the sleazy Sun newspaper, London’s best-known gutter-press publication, the Algerian newspapers, in every language, have endeavoured to demonstrate to their readers that Morocco is not a safe country and that the vast majority of Daesh terrorists in Syria are of Moroccan origin.

Not satisfied with simply doing their dirty work of twisting the facts, the press of our Eastern neighbour has been cooing with pleasure and has been making such a big deal of announcing that our tourism industry will be affected, that the Kingdom will slide further into crisis, that foreigners will quickly desert the Kingdom or now will no longer go there.

According to these ‘vulture’ publications, European capitals are under threat from Moroccan terrorists affiliated to Daesh and Spain, with whom Morocco enjoys high-quality relations when it comes to security, is the country most at risk.

These articles from the neighbouring press are inadmissible, unacceptable and nothing short of scurrilous!

A case of the pot calling the kettle black

By behaving in such a way, the Algerian press has blatantly violated journalism’s professional code of ethics in making outrageous and systematic accusations and by ignoring the essential and fundamental requirement which is to reject any form of terrorism, regardless of where it occurs.

Admittedly, the Moroccan press generally tends to be hard on the Algerian regime but no one in Morocco ever dared glorify the Islamist armed groups that sowed terror in Algeria between 1998 and 2004, which resulted in more than 200,000 dead and missing during that civil war!

More recently, when AQIM terrorists led by Mokhtar The One-Eyed took dozens of people hostage at the BP-Sonatrach gas plant in Ain Amenas in January 2013, the Moroccan press did not seize upon this opportunity to stigmatise Algeria and its people.

Because, as far as we are concerned, the death of 40 employees of ten different nationalities is not an occasion to rejoice in such a tragedy.

We will be sure to look into the causes and reasons for such an outrageously anti-Moroccan attitude.

Algerian journalists, whom we have the decency to call our ‘peers’, are surely not ignorant of the fact that the knee-jerk reaction to any terrorist act perpetrated in any one North African country is, simplistically and harmfully, to lump together all other countries within the entire region.

All in the same boat!

The consequence of an attack in the Aurès Mountains in Algeria, a clash with armed Islamists near Mount Chaambi in Tunisia, a double murder in Imlil is that every North Africa state is stigmatised, blamed and blacklisted by a section of the Western press, reinforcing among European public opinion (in particular) the false but long-held conviction that these countries are plagued by insecurity and instability.

In addition, by behaving in this way, the Algerian press is doing its very best to discredit Algiers’ official line which states that terrorism and armed groups are no longer operational in that country.

But, above all, to take such devilish pleasure in the misfortune of others, to take advantage of a horrible terrorist murder in order to attack a neighbouring state and a sister nation, is despicable, filthy, petty and vile!

Given the context, it is worth recalling the words of President François Mitterrand, who denounced the attitude of the French press whom he held responsible for the suicide of former Prime Minister Pierre Bérégovoy 1 May 1993:

“There can be no justifiable explanation for feeding a man’s honour to the hounds…”.

Allow us to adapt this verdict and write: “There can be no justifiable explanation for feeding the honour of a country and its people to the jackals and hyenas…”.

Fahd YATA

Original article : https://lnt.ma/presse-les-chiens/

The post Hurry, the hounds… appeared first on La Nouvelle Tribune.

]]>The post Interview with Mr Adil Douiri, founder of Mutandis, following the company’s very successful IPO appeared first on La Nouvelle Tribune.

]]>Of course! The public offering went well, especially given the rather gloomy stock market conditions that we are currently experiencing and the backdrop of sluggish growth for the domestic economy!

Last September, Mutandis’ Supervisory Board decided to go ahead with this IPO in the belief that the stars would never be perfectly aligned, nor would there be a more opportune moment from a stock market perspective. The fact that our company was to be listed for the long term, it was important that the IPO price was attractive.

And what we proposed was an attractive 180 dirhams a share, a 19% discount to the company’s ‘fair value’ of more than 220 DH.

In addition, Mutandis is paying a decent dividend of 7.5 DH for a par value of 100 DH. We also decided to give the new shares entitlement from early 2018, enabling the new shareholders to benefit from the 2018 dividend even though they only joined us in December.

I would like to emphasise that the dividend is an integral part of the stock’s overall performance.

The dividend is not simply the icing on the cake!

By comparison with the expected return from the Casablanca stock market of around 9.3% annually (3.3% for the risk-free rate of return plus a 6% risk premium), Mutandis’ 4.2% dividend on its IPO valuation is already halfway to equalling this expected return.

So, the size of the dividend is already a good start!

The deal enabled us to raise MAD 1 billion for MAD 400 million offered, despite our road show only lasting for two weeks.

And there was a good reason for that. We did not obtain the AMMC visa until 16 November and we had to close the deal before 18 December since foreign investors are not able to settle beyond 21 December due to their Christmas break.

So, by counting backwards, the subscription period had to be between 3 and 7 December to allow the Stock Exchange ten days for recounts, allocations and attributions, prior to posting the results of the public offering.

Despite all this, the deal was a great success, being 2.5 times oversubscribed.

What was the breakdown of subscriber applications?

It is better to analyse it by investor type, knowing that applicants could subscribe for different tranches.

As a result, 54% of demand was from Moroccan institutional investors, 23% from retail investors and foreign institutional investors 23%.

It is also important to mention that Mutandis attracted 3,200 retail investors compared to about 1,300 for Immorente, 2,900 for Total and 1,900 for AFMA.

Of the last 4 public offerings (excluding Marsa Maroc’s privatisation), Mutandis has attracted the largest number of retail investors.

I personally attribute this success to our products’ simplicity. People have a perfect understanding of what we manufacture because they use our products on a daily basis.

The way in which we structured the different tranches was a technical arrangement to be able to allocate a significant portion to foreign investors who, should their allocation have been scaled back, would not have subscribed, preferring instead to purchase the shares at a later date on the open market.

But we wanted foreigners to participate in this IPO, in the same way as, in concertation with the AMMC, we wanted to attract retail investors.

And so, to ensure that their needs were met, they were allocated a specific tranche (Tranche III) with two requirements: a MAD 10 million minimum subscription and a 3-month ‘lock-up’ period.

This worked well and the allotment ratio for Tranche III was 76% compared to only 34% for Tranche II (Moroccan institutions investing more than MAD 10 million with a 3-month lock-up period) and 36% for the general public (Tranche I).

What does the post-IPO capital structure look like?

Mutandis’ stable (‘hard core’) group of shareholders account for 34% of its capital in the wake of this equity offering.

These shareholders include Adil Douiri, Label’Vie, the FinanceCom Group subsidiaries and Améthis.

It is worth mentioning that Mr Douiri and Rothschild Group’s Amethis Finance subscribed to the IPO so as not to be diluted.

The second third of the capital is held by long-standing shareholders which currently total just under 60, a number that has grown steadily in the wake of successive equity offerings since 2008.

The final third of the capital belongs to new shareholders which invested in this IPO with new foreign investors accounting for 8%.

But these last two shareholder categories should be considered as comprising Mutandis’ free float.

So, 65% of Mutandis’ capital listed on the Casablanca Stock Exchange comprises its free float?

Indeed, whilst it’s something of a novelty in Morocco for a company to be governed by a minority shareholder, it is, however, more common in more developed stock markets.

Assuming that a properly listed company must be sufficiently liquid to allow as many buy and sell transactions as possible, the share price will then reflect the company’s actual value.

For a society to be liquid and for its shares to be tradeable, it must have an adequate free float in dirhams; in Mutandis’ case, 65% of the free float equates to a MAD 1 billion free float.

There is no relationship, however, between having a sufficient free float and the upward or downward movement in the company’s share price. A sufficient free float simply ensures that a stock market price reflects market expectations.

It also ensures that foreign investors are not discouraged in advance by concerns about liquidity and will invest in the stock.

It is worth noting that on the Casablanca Stock Exchange, there is a free float-weighted index in which Mutandis is ranked around 20th out of the 75 companies listed in terms of liquidity, while in market capitalisation terms i.e. its overall value, the company is ranked 40th.

But one must also be aware that within this free float, there is some ‘false free float’ i.e. core portfolio holdings held by Moroccan institutional investors which, after bidding for MAD 540 million of the MAD 1 billion raised, were allocated about MAD 200 million.

They are known to be medium and long-term income investors who are remunerated through the dividend yield.

Mr Douiri, please would you explain to our readers why you chose the legal form of a limited partnership?

A limited partnership is a legal form which reconciles two generally irreconcilable goals, on the one hand, engaging in a series of equity issues so as to grow the company quickly and, on the other, ensuring stable governance. Moroccan limited companies often have an owner who owns at least 51% shareholder of the equity and has a controlling interest.

The result is that this shareholder, so as not to lose control, restrains or even slows the company’s growth.

In Mutandis’ case, because of its legal form, the company has grown rapidly without its founder needing to inject more capital. This has been achieved by increasing the number of partners (shareholders) and their contributions.

The limited partnership structure enables the company to achieve its goal of rapid growth through regular capital calls.